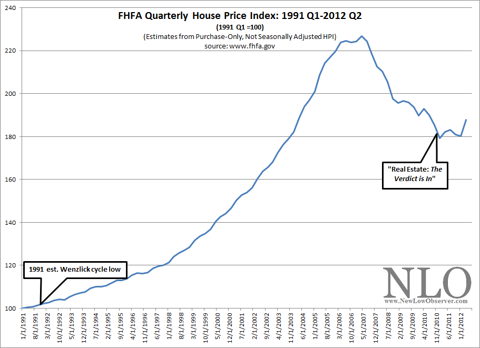

In the days leading up to the great recession, California led the country in subprime mortgage loans — reckless transactions that played a major role in the housing market bust, both here and throughout the rest of the country. However, a new RealtyTrac data report published in the San Francisco Chronicle shows the California housing market now leading the way to real estate recovery through a combination of reduced defaults, increased demand in move-up markets and lively activity on the part of investors.

After being buried in the aftermath of countless foreclosures following the implosion of the housing bubble, California has finally succeeded in stabilizing the housing market. The latest RealtyTrac data shows U.S. foreclosure filings at their lowest in nearly five years – thanks in large part to a dramatic reduction in defaults throughout California. Initial statewide default filings fell to their lowest point in 69 months, signifying a decrease of 45% compared to this time last year. Meanwhile, home sales in the state’s most populous regions jumped to highest rates since 2006 as of August 2012. Across the nation, housing market trends are mirroring California’s advances” defaults fell by 34% in Arizona, 22% in Michigan and 21% in Georgia, while overall U.S. home values rose by 1.2% relative to last year’s figures.

In addition to reduced defaults, California has also enjoyed a brisk uptake in market activity from investors and move-up buyers, with the bulk of real estate purchase power centered in the coastal markets and moving steadily inland into the autumn months.

From reckless lending to smart investing: the future of California real estate

With California moving swiftly ahead in the direction of real estate recovery, now is the time for move-up buyers to capitalize on comparatively low home prices and historically low interest rates while they still can. Here in Santa Cruz, the time is ripe for qualified buyers in desirable coastal markets.

To learn more contact Authentic Real Estate and find out about the current trend in South Bay Area real estate: http://www.authenticre.com or (831) 426 0294

![[image]](http://s.wsj.net/public/resources/images/OB-UI651_smbtng_NS_20120828184727.jpg)