Image via Wikipedia

Image via WikipediaA few years back developers in Orlando, Fla., thought they had it all figured out. With apartments rapidly being converted to condominiums, they started building new apartment complexes to absorb all the renters who didn't want to buy.

Then the economy went into recession, vacationers stopped going to Disney World, and financing evaporated for developers and buyers alike. Result: More than one-fifth of Orlando's rental units are vacant, landing it the top spot on Forbes' list of America's Emptiest Cities.

"There was supposed to be a need for new rental product to replace what was being taken out of the market," said Ken Delvillar, director of apartment brokerage services at Cushman & Wakefield in Orlando. Developers "were trying to look ahead of the curve."

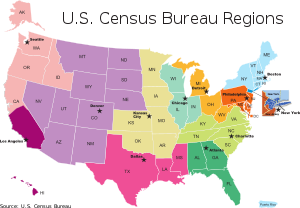

That mistaken prediction pushed Orlando's rental vacancy rate to 23.6 percent in the fourth quarter of 2010, second only to Dayton, Ohio, among the nation's 75 largest metropolitan areas surveyed by the U.S. Census Department. Orlando's high vacancy rate for single-family homes — 8 percent at the beginning of 2010 — pushed it to No. 1 overall.

To construct our list, we ranked cities over all four quarters of last year by single-family and rental vacancy rates, then averaged the ranks to determine the top 10.

Las Vegas comes in second, with its bloated inventory of homes left over from the housing bubble. Sin City's single-family vacancy rate of 5.5 percent at the end of last year — more than 7,000 empty homes in the city proper, according to Census estimates — was among the highest in the country. Rental properties were a little closer to the national average at 13.5 percent. Nationwide the single-family vacancy rate ended the year at 2.7 percent while rentals were at 9.4 percent.

At No. 3 is Memphis, Tenn. The city's 9.4 percent unemployment rate isn't particularly high, but there are thousands of units of deteriorating rental property near the city's center, helping to push the rental vacancy rate to 16 percent in the fourth quarter of 2010, according to the Census Department, down from 21 percent at mid-year.

"There are several pockets of blight around the city, and as a result, absentee property owners have responded by boarding up their properties," said Mark Fogelman of Fogelman Management Group, a closely held property firm with 5,000 units in Memphis. Those blighted areas exaggerate the Memphis vacancy rate, Fogelman says, which has been stable at 7 percent to 8 percent in most of the city's other submarkets.

In Orlando, like many cities on the list, the apartment market is split in half. At the top end, so-called Class A complexes have occupancy rates around 90 percent, and owners are beginning to raise rents. Class B complexes are also full, said Delvillar of Cushman & Wakefield. Dragging down the market are Class C properties, many of them built in the 1970s and 1980s, where occupancy rates are in the 60 percent range and landlords have difficulty collecting rent.

Delvillar cited one fixer-upper apartment complex on the market for $2.5 million, down from its last purchase price of $7.5 million. At 60 percent occupancy this complex doesn't have a return on investment right now; rents don't even cover operating expenses. But Orlando's unemployment rate is coming down, and the sun always eventually shines on Florida property markets. At least until the next bubble bursts.

Then the economy went into recession, vacationers stopped going to Disney World, and financing evaporated for developers and buyers alike. Result: More than one-fifth of Orlando's rental units are vacant, landing it the top spot on Forbes' list of America's Emptiest Cities.

"There was supposed to be a need for new rental product to replace what was being taken out of the market," said Ken Delvillar, director of apartment brokerage services at Cushman & Wakefield in Orlando. Developers "were trying to look ahead of the curve."

That mistaken prediction pushed Orlando's rental vacancy rate to 23.6 percent in the fourth quarter of 2010, second only to Dayton, Ohio, among the nation's 75 largest metropolitan areas surveyed by the U.S. Census Department. Orlando's high vacancy rate for single-family homes — 8 percent at the beginning of 2010 — pushed it to No. 1 overall.

To construct our list, we ranked cities over all four quarters of last year by single-family and rental vacancy rates, then averaged the ranks to determine the top 10.

Las Vegas comes in second, with its bloated inventory of homes left over from the housing bubble. Sin City's single-family vacancy rate of 5.5 percent at the end of last year — more than 7,000 empty homes in the city proper, according to Census estimates — was among the highest in the country. Rental properties were a little closer to the national average at 13.5 percent. Nationwide the single-family vacancy rate ended the year at 2.7 percent while rentals were at 9.4 percent.

At No. 3 is Memphis, Tenn. The city's 9.4 percent unemployment rate isn't particularly high, but there are thousands of units of deteriorating rental property near the city's center, helping to push the rental vacancy rate to 16 percent in the fourth quarter of 2010, according to the Census Department, down from 21 percent at mid-year.

"There are several pockets of blight around the city, and as a result, absentee property owners have responded by boarding up their properties," said Mark Fogelman of Fogelman Management Group, a closely held property firm with 5,000 units in Memphis. Those blighted areas exaggerate the Memphis vacancy rate, Fogelman says, which has been stable at 7 percent to 8 percent in most of the city's other submarkets.

In Orlando, like many cities on the list, the apartment market is split in half. At the top end, so-called Class A complexes have occupancy rates around 90 percent, and owners are beginning to raise rents. Class B complexes are also full, said Delvillar of Cushman & Wakefield. Dragging down the market are Class C properties, many of them built in the 1970s and 1980s, where occupancy rates are in the 60 percent range and landlords have difficulty collecting rent.

Delvillar cited one fixer-upper apartment complex on the market for $2.5 million, down from its last purchase price of $7.5 million. At 60 percent occupancy this complex doesn't have a return on investment right now; rents don't even cover operating expenses. But Orlando's unemployment rate is coming down, and the sun always eventually shines on Florida property markets. At least until the next bubble bursts.